One of the best business structures for today’s small business owners is an LLC, but what is a limited liability company?

An LLC is a state-sanctioned business entity unto itself. It offers the limited liability protection of a corporation and the tax efficiencies of a sole proprietorship or partnership. The business owners are called members.

That is a concise limited liability company definition. Below I’ll discuss in greater detail what is an LLC.

What is a Limited Liability Company?

The name Limited Liability Company gives away one of the major advantages of this business structure. This business structure limits the liability of the members and employees. Let’s learn why.

Note: I am a small business owner who writes on business-related topics. Such topics often include legal elements. The information here is not legal advice. Utilize the topics here in preparation for your discussion with your legal counsel.

How to Set up an LLC

Once you’re ready to formalize your business structure, you will want to discuss the plan with your attorney. If they also agree that an LLC is right for you, your attorney will likely offer to do this for you. However, setting up a limited liability company is fairly easy. The first thing that you’ll need is the name of your business.

Secretary of State Business Search

You’ll begin by visiting the Secretary of State’s website for the state you are organizing your business. The first thing you want to do is conduct a business name search. It is your responsibility to ensure that the name you select for your business isn’t already in use in your state. The name that you select must include an applicable LLC ending.

Now you’ll create your Articles of Organization.

Note: This article contains affiliate links. That means we may get paid a commission if you purchase something through one of our links. There is no additional cost to you. It is simply how we fund Efficient Soloprenuer.

What are Articles of Organization

The Articles of Organization is the legal document that articulates the governance of your LLC. It defines the power, rights, liabilities, duties, and other important obligations of and between the LLC members. The Articles of Organization include:

- The name of the LLC

- The names and addresses of each person executing the Articles of Organization

- The determination of Member Managed or Manager Managed

- The Registered Agent

- The physical and mailing address

There are often addition (optional) provisions which may include:

- Names of the LLC’s initial Officials

- The purpose of the company

- Provisions for managing the business

An LLC Operating Agreement isn’t required as part of your legal formation, but we will discuss the importance of it next.

LLC Operating Agreement

An LLC operating agreement explicitly states how decisions will be made and how profits are distributed.

LLC Ownership

The owners of an LLC are called members. Each member, their portion of ownership and compensation are addressed in the Operational Agreement. LLC ownership is much more flexible than an S-Corp. There is no limit to the number of members in an LLC. There are also no national citizenship requirements.

What is a Registered Agent

The registered agent is an individual or entity authorized to accept delivery of legal documents on behalf of the LLC. The registered agent can be a member of the LLC. The registered agent must be a resident with a physical address in the state of the LLC. If your LLC will do business in many states, you may be required to get “foreign qualification” in those states.

What is Member-Managed versus Manager-Managed

Within your Articles of Organization, the members agree who will be responsible for the day to day operations of the business. In most states, if this position isn’t designated it will default to member-managed. In a manager-managed LLC, a manager is brought on board to handle the day to day operation of the LLC. This person is an employee. Since a solopreneur doesn’t have employees, they would be member-managed.

Are you familiar with what a solopreneur is?

LLC Entity Type

A limited liability company is a state-sanctioned entity. It is not unincorporated, but it isn’t a corporation either. It does provide the limited liability protection of a corporation and is legally an entity unto itself.

LLC Ownership

A limited liability company is owned by its members. While a sole proprietorship is owned by its owner, owners of an LLC are called members. All members must be listed in the Articles of Organization.

LLC Startup Cost

The limited liability company start-up cost includes:

- Creation of your Articles of Organization fee

- Filing of your Articles of Organization fee

- Registered Agent fee(s)

- Creation of the Operating Agreement fee

- Funding business bank account(s)

- State and municipal licenses and permits fees

How is an LLC Taxed

Limited liability companies pass their profits through to their members. The members, in turn, are taxed annually on their personal tax returns. This is referred to as pass-through because the income is not subject to tax at the company level prior to the member’s individual income tax filing.

LLCs avoid the franchise tax imposed on corporations.

Members may be required to file quarterly estimated taxes. Members are also subject to self-employment tax consisting of Social Security tax and Medicare tax.

LLC Tax Rate

Limited liability companies are pass-through entities unless the company files to be taxed otherwise. Therefore the LLC’s revenues from sales are not taxed at the company level. All of the profit is passed-through taxation.

Members are taxed on their portion of the profit. The personal tax rate ranges from 10 percent to 37 percent, according to the IRS 2020 marginal rates. The rate scales with your personal income level.

Quarterly estimated-taxes may be required. Self-employment taxes are also required.

How are LLC Owners Paid

Members are entitled to all the profits from an LLC. How members are paid and what percentage of the profit each member receives is documented in the Operating Agreement. Members are paid via an owner’s draw.

If the LLC files to be taxed as an S-corporation, then the compensation model changes significantly. In that scenario, the members working in the business become employees and are paid a salary.

LLC Liability Protection

Members of a limited liability company have limited liability protection from business financial obligations, losses, and liabilities. If the company is unable to meet its financial obligations, its creditors are limited to the assets of the business.

Members can forfeit their limited liability protection if they:

- Personally guarantee a business debt on which the LLC defaults.

- Pierce the corporate veil:

- Co-mingle the LLC’s and personal finances

- Blend the lines between personal and company business

- Are reckless or negligent in business.

This limitation of liability is a major benefit of an LLC. It affords the owners a shield between the business assets and their personal property.

LLC Investment Options

A limited liability company is member owned. It does not have shares like a corporation unless it files for a more complex tax structure (ie. S Corp designation).

The LLC can accept investment for a percentage of the company. In this case, the investor would become a member.

An LLC can also accept grants and loans.

LLC Perpetual existence

An LLC’s duration is written with it’s Articles of Organization. If the state in which the LLC is created allows the LLC to declare a perpetual existence within it’s Articles of Organization, then succession is set forth within the LLC’s Operating Agreement.

Limited Liability Company’s Ongoing Requirements

Limited liability companies must file an annual report in order to maintain their standing with the Secretary of State(s) in which the company is organized. Failure to file the annual report may lead the Secretary of State to declare the LLC as dissolved.

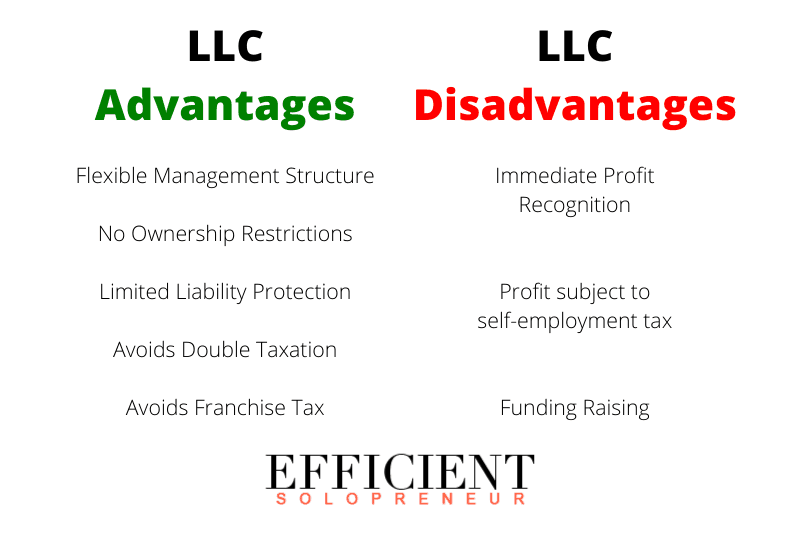

LLC Advantages and Disadvantages

An LLC is a fantastic business structure for many small business owners. The liability protection of a corporation and the tax simplicity of a sole proprietorship lends itself well to solopreneurs.

Let’s summarize the pros and cons of an LLC below:

Advantages of an LLC

- Flexible management structure

- No ownership restrictions

- Limited liability

- Avoids double taxation of a C corporation

- Avoids franchise tax of a corporation

- Investors can opt for a manager-managed LLC

Let’s examine the disadvantages of an LLC

Disadvantages of an LLC

There are really great advantages for LLC business structure, but there are also several disadvantages.

- As a pass-through entity, owners must immediately recognize profits

- Profits subject to self-employment taxes.

- Raising Funding: An LLC doesn’t have shares (stock) unless it opts for S-Corp taxation

An LLC is an amazing business structure for small business owners and solopreneurs. For comparison, I’ve reviewed how an LLC compares to a sole proprietorship.

Note: This article is written based on the definitions established here in the United States of America. Similar business structures exist worldwide. Definitions are different and nuanced based on the jurisdiction in which you reside.

Enjoy Life as a Solopreneur

Becoming a solopreneur can change your life for the better. You can take full advantage of the flexibility and control while capitalizing on your passion and honing important skills.

If you are a solopreneur, you are in the right place. The Efficient Solopreneur is here to help you work smarter and eclipse your goals! Join YOUR tribe and subscribe to our mailing list. We will help you stay abreast of the information to help you gain and maintain a competitive advantage!

Sources:

- IRS: Limited Liability Company LLC

- SBA: Choose a Business Structure

- NC Secretary of State: LLC Articles of Organization Requirements