You are ready to start a small business, but what is the best business structure for solopreneurs: Sole Proprietorship vs LLC?

Although a sole proprietorship is the easiest business structure to create, a limited liability company (LLC) is often preferred because it affords personal liability protection.

What is a Sole Proprietorship

A sole proprietorship is the easiest and most common business structure to create. It’s owned and run by one person, the proprietor. There is no distinction between the owner and the business. The owner is entitled to all the profits which are filed on their tax returns. The owner is also personally responsible for business obligations, losses, and liabilities.

Note: I am a small business owner who writes on business-related topics. Such topics often include legal elements. The information here is not legal advice. Utilize the topics here in preparation for your discussion with your legal counsel.

How to Set up a Sole Proprietorship

Forming a sole proprietorship is easy because it’s assumed unless you file otherwise. There is no formation paperwork required if you do business in your legal name.

If you choose a different name for your business, you need to file an Assumed Name. You do that with the Office of the Register of Deeds.

Many people have functioned as a sole proprietor without realizing it. For example, receiving money in exchange for a product or service, like lawn service or baking a cake.

What are the Pros and Cons of Sole Proprietorship

Pros:

- It’s easy to set up.

- The startup cost is minimal.

Cons:

- You are personally liable for business obligations and losses.

We’ve discussed sole proprietorship, Let’s now review limited liability companies as we determine the best business structure for solopreneurs: Sole Proprietorship vs LLC.

Are you wondering what a solopreneur is?

What is a Limited Liability Company

A Limited Liability Company is a state-sanctioned entity unto itself. The business owners are called members. They have limited liability protection from business financial obligations, losses, and liabilities. If the company is unable to meet its financial obligations, its creditors are limited to the assets of the business.

Members are entitled to all the profits from an LLC. Such profits are filed on the member’s individual tax returns. This is referred to as pass-through because the income is not subject to tax prior to the members individual income tax filing.

Members can forfeit their limited liability protection if they:

- Personally guarantee a business debt on which the LLC defaults.

- Pierce the corporate veil:

- Co-mingle the LLC’s and personal finances

- Blend the lines between personal and company business

- Are reckless or negligent in business.

This limitation of liability is a major benefit of an LLC. It affords the owners a shield between the business assets and their personal property.

Note: This article contains affiliate links. That means we may get paid a commission if you purchase something through one of our links. There is no additional cost to you. It is simply how we fund Efficient Soloprenuer.

How to Start an LLC

An LLC is a business structure instituted at the State level. You will need to contact your Secretary of State to apply. This is often accomplished online in minutes. You fill out an application, upload your Articles of Organization, and pay a fee to the Secretary of State.

As a solopreneur you will need these three things to get started:

- A business name for your LLC. Check your desired name against the business names already registered in your state.

- Your Articles of Organization. It’s recommended to sit with an attorney to assemble this document. There are several online businesses that can automate this process as well.

- Your Registered Agent. The person or entity who accepts your legal correspondence on behalf of the LLC.

As a solopreneur, you are most often member-managed. This is the default designation for single-member limited liability companies (SMLLC). In some states, it’s required to have an Operating Agreement. This is a good document to have even if it is not required in your state. Each year you must file an annual report to maintain your LLC with the state. Failure to update your filing and pay the annual fees will result in incremental fees. The LLC may also face suspension or forfeited if filings and fees are not kept up.

What are Articles of Organization

The Articles of Organization specify the governance of the LLC. It establishes the power, rights, liabilities, duties, and other important obligations of and between the LLC’s members. The Articles include:

- The name for the LLC

- The legal business structure

- The Registered Agent

- Determination of Member Managed or Manager Managed

- The effective date of the LLC

- The duration of the LLC

- The names, addresses, and signatures of the organizers and managers.

What is a Registered Agent

The registered agent is an individual or entity authorized to accept delivery of legal documents on behalf of the LLC. The registered agent can be a member of the LLC. The registered agent must be a resident with a physical address in the state of the LLC. If your LLC will do business in many states, you may be required to get “foreign qualification” in those states.

What is an Operating Agreement

An LLC’s Operating Agreement outlines the financial and functional decision making in a structured manner. This document is a binding set of rules for the members to abide by. The absence of this document may require the business to execute according to the default rules of the State. The agreement includes but is not limited to:

- Organization

- Percentage of members’ ownership

- Responsibilities and Voting

- Distributions of profit and loses

- Membership Changes

- Dissolution

Although this agreement may not be required by the State when forming your LLC, it is unwise to operate without one.

What is Member-Managed versus Manager-Managed

Within your Articles of Organization, the members agree who will be responsible for the day to day operations of the business. In most states, if this position isn’t designated it will default to member-managed. In a manager-managed LLC, a manager is brought onboard to handle the day to day operation of the LLC. This person is an employee. Since a solopreneur doesn’t have employees, they would be member-managed.

What are the Pros and Cons of an LLC

Pros:

- It provides a shield between business and personal assets.

- It’s easy to set up.

- The startup costs are low.

Cons:

- Higher startup cost compared to a sole proprietorship.

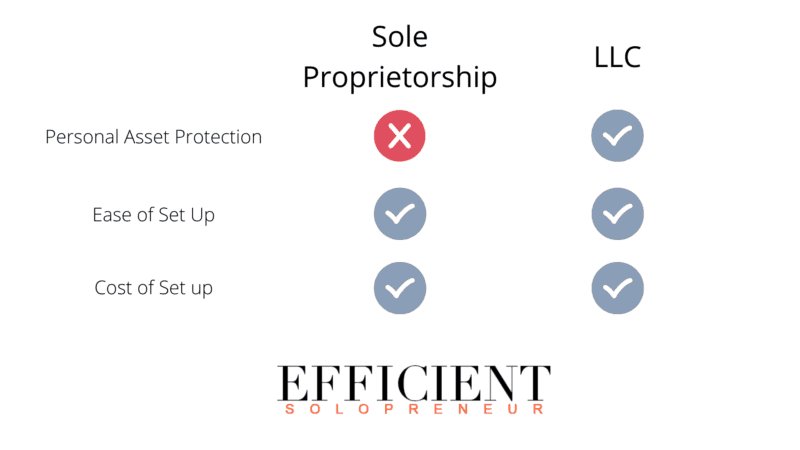

We’ve now discussed sole proprietorship and limited liability companies. Let’s review and determine the best business structure for solopreneurs as we evaluate sole proprietorship vs LLC.

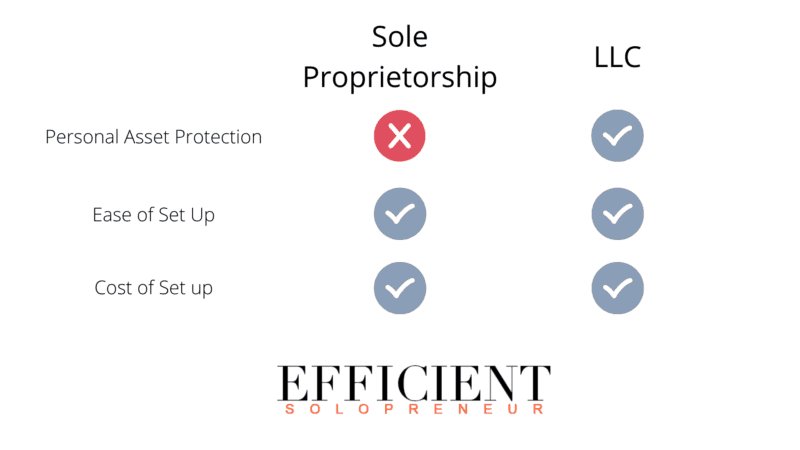

Let’s evaluate the best business structure for solopreneurs

A sole proprietorship is the easiest and least expensive business structure to create. The owner receives all the business profits and is taxed annually on the individual’s income tax filing. An LLC is also easy to set up but slightly more expensive. The owner must maintain their LLC filings with the Secretary of State. The major benefit of an LLC is personal asset protection. For this reason, an LLC is the preferred business structure.

A few more important actions

You have determined the best business structure for solopreneurs, but this is just the beginning. There are a few more common actions to take before your grand opening.

Licensing and Permits

Before starting your business, leverage the SBA’s Licensing & Permits tool. You’ll identify the permits, licenses and registrations required to operate your business. Registering for Sales and Use Tax and applying for permits are common requirements.

Apply for an EIN

The EIN or Employer Identification Number is issued for the purpose of tax administration. Most new single-member LLCs classified as disregarded entities (taxed as sole proprietors) will need to obtain an EIN. Application for an EIN is made with the IRS.

Apply for a business bank account

Once you have your EIN, you may now open bank accounts under your business name. These accounts are owned by the business. They are not the same structure as accounts opened by sole proprietors who are Doing Business As (dba) an Assumed Business Name.

Now that you’ve determined the best business structure for solopreneurs, it’s time to put your plan into action.

Note: This article is written based on the definitions established here in the United States of America. Similar business structures exist worldwide. Definitions are different and nuanced based on the jurisdiction in which you reside.

Enjoy Life as a Solopreneur

Becoming a solopreneur can change your life for the better. You can take full advantage of the flexibility and control while capitalizing on your passion and honing important skills.

If you are a solopreneur, you are in the right place. The Efficient Solopreneur is here to help you work smarter and eclipse your goals! Join YOUR tribe and subscribe to our mailing list. We will help you stay abreast of the information to help you gain and maintain a competitive advantage!